Calendar Year Pass (January-December) - Under the law, any qualifying person receiving Supplemental Security Income (SSI) [CA State Welfare and Institutions Code Section 12200]; any person receiving aid under the CalWORKS Program; or any person 62 years of age or older with income limitations specified on the application form is eligible to receive the Golden Bear Pass.

Identification

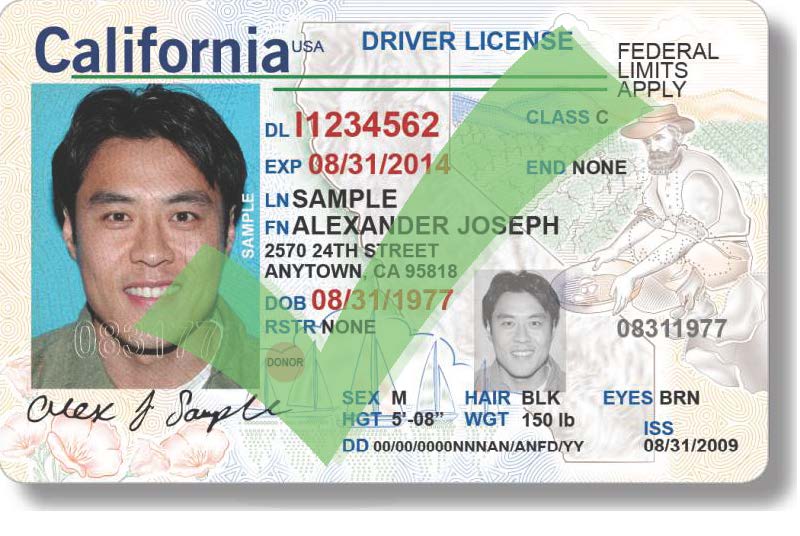

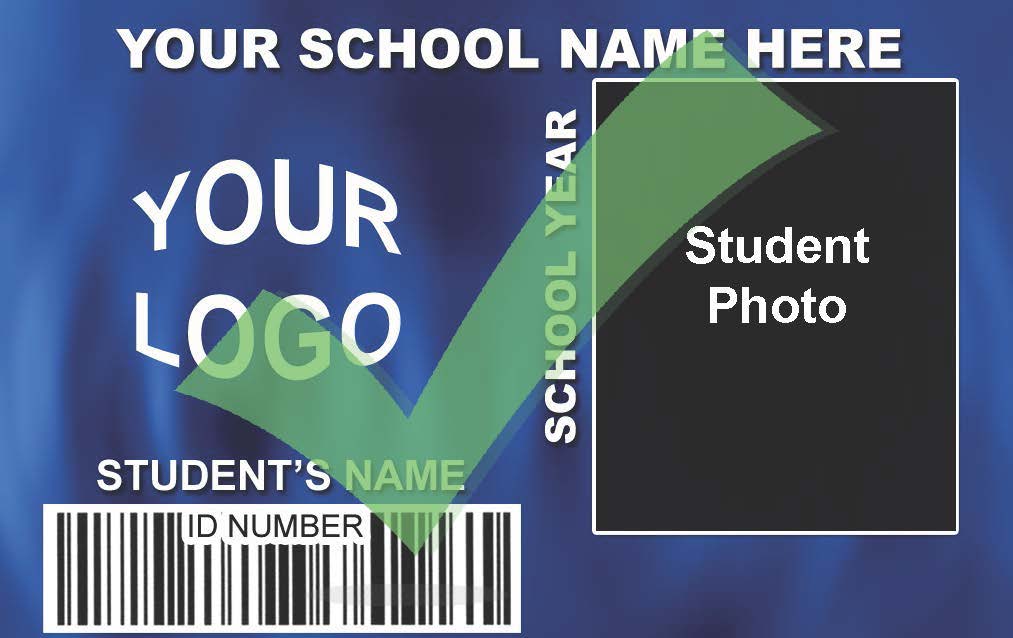

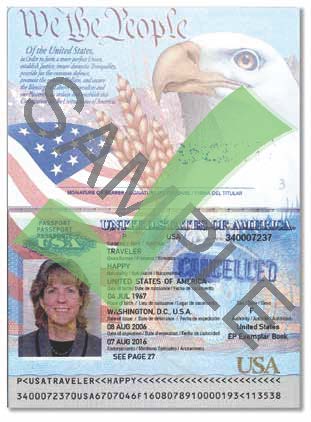

- A copy of a valid driver license/picture ID, issued by the State or Federal Government, or a current school ID for applicant and spouse or registered domestic partner if named on pass.

- Interim, temporary or expired identification will not be accepted, no exceptions.

Some examples of documents that are and are not accepted:

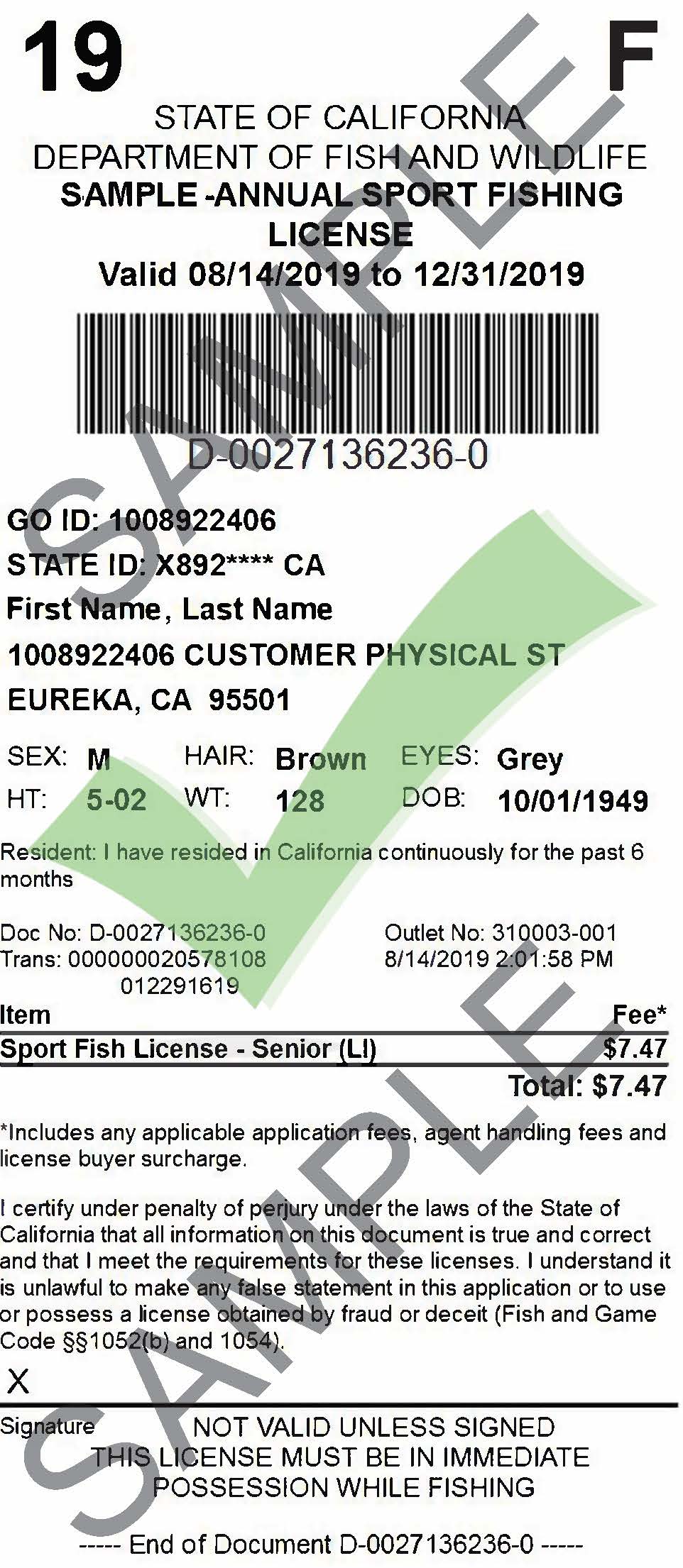

Example: |

Example: |

Example:  |

Example:  |

|

Accepted |

Accepted |

Accepted |

Not Accepted

|

Certification Materials

Please select one of the provisions below.

1. Supplemental Security Income Payment Decision

- Applicant must provide a current statement of SSI benefits or current verification letter showing applicant is receiving Supplemental Security benefits from the US Social Security Administration. Applicant must be at least 16 years of age.

2. CalWORKS Program

- Under the provisions of the California State Welfare and Institutions Code begining at section 11200 - Applicant must verify their CalWORKs case is ACTIVE in the month the Golden Bear Pass application is submitting by providing documentation from their county social services agency.

- Find your county agency office here

- Verification letters can be prequested by calling the CalWORKs service center at (916)874-3100 or (209)744-0499.

3. Income Verification - Single (Age 62 or over)*

- Single, age 62 or over and average gross monthly income from all sourced does not exceed amount indicated on most current application (complete and attach page 2 of the application) OR

4. Income Verification - Married (Age 62 or over)*

- Married or registered domestic partnership, primary applicant age 62 or over and combined average gross monthly income from all sources does not exceed amount indicated on most current application (complete and attach page 2 of the application).

*If you choose to apply under one of the provisions listed above, please choose one of the following two options for income certification and complete and sign the Golden Bear Income Declaration section at the bottom of page 2.

I. Current "Reduced-Fee Sport Fishing License: Senior-Limited Income (LI)" issued by the California Department of Fish and Wildlife (what is a reduced fee fishing license?)

|

Example:

|

|

Accepted |

II. Declaration of Total Gross Annual Income** Sources - Complete the income table on page two of the application and attach supporting documentation. Applicant must attach any and all associated documentation providing "Proof of Income". Accepted documents are listed on the application.

**Total gross income means an individual's total income before taxes or deductions. This includes all sources of income including, but not limited to: Salaries, commission, bonuses, social security, pensions, disbursements from retirement accounts, workers' compensation benefits, unemployment insurance benefits, rent, interest income, welfare payments, grants and educational allowances.